The world of complex financial systems revolves around liquidity,'I'd simply sum these up into, two categories

- Liquidity Source

- Liquidity Sink

In the context of trading, liquidity refers to the ability to buy or sell an asset (such as a cryptocurrency) with the goal being quick and with minimal price impact.

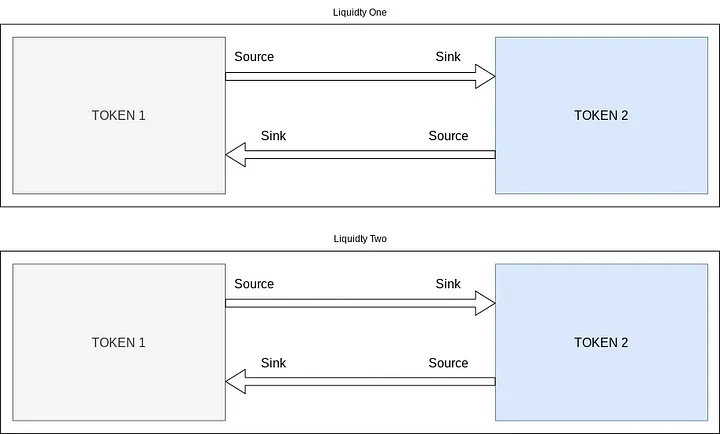

A “liquidity pair” is a trading pair in which there are two different tokens, allowing many buyers and sellers to trade these tokens, thus affecting the price of the pair. Only buys and sells affect the price of a trading pair, adding liquidity does not as the added liquidity is 1:1 which only helps to stabilise the price fluctuations in the pool.

A “liquidity source” provides a large amount of liquidity for a particular asset.

A “liquidity sink” is the opposite it absorbs a large amount of liquidity for a particular asset. A store of value.

What happens if we double these categories

There are now two liquidity sources and two liquidity sinks.

When one of these a source or a sink interacts with buyers or sellers the other pair for a moment or period is at a different price which can only be higher or lower compared to the other pair.

We now have an arbitrage opportunity where we can introduce a new buyer or seller who 'asn't been involved in the original trade but has created balance among the liquidity sources and liquidity sinks, while at the same time creating a profit via trading fees for the liquidity providers.

Arbitrage trading can be done manually by traders who keep track of price differences across different markets and execute trades accordingly. However, with the advent of technology and the increasing number of exchanges and markets, it has become more common for traders to use arbitrage trading bots to automate the process.

An arbitrage trading bot is a software program that monitors price differences across different markets and executes trades automatically when it detects an opportunity for profit. These bots can be programmed to scan multiple markets and exchanges at once and can execute trades much faster than a human trader could. They can also be programmed to take into account factors such as trading fees and order book depth to maximize potential profits.

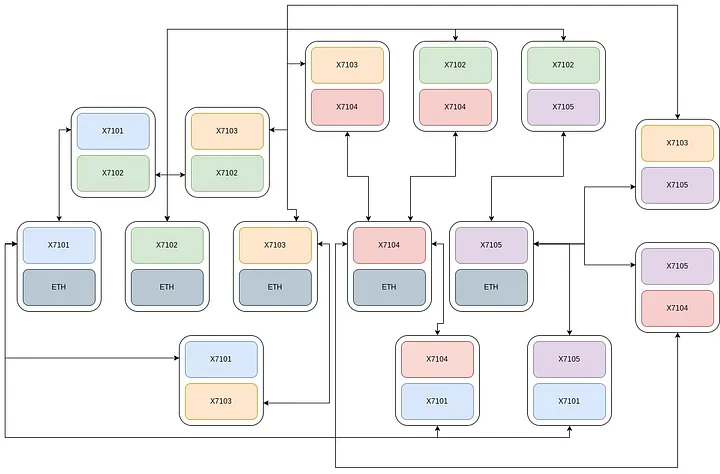

If we increase the number of tokens that are inter-tradeable with each other this creates more opportunities for buyers, sellers, and arbitrage trading.

What if the trading profits from the liquidity provider were re-invested into the liquidity sink?

And at the same time, it purchased and burned one of the tokens reducing the supply.

As more trading activity in the pools increases, the demand for the tokens also increases, which can drive up the price. The reinvestment of trading fees and token burns also help to support the price by decreasing the supply and increasing the demand.

As the price of the tokens increases, the value of the liquidity pools also increases, making them more attractive to traders and further increasing the demand for the tokens. This creates a positive feedback loop where the increasing demand and price of the tokens support the liquidity pools, which in turn supports the price of the tokens.

Over time, this can lead to a continuously rising floor price for the tokens as the demand and price increase, making them a more attractive store of value for investors. This creates an ecosystem where the liquidity pools, trading fees, token burns, and token prices are all working together.

The X7 Finance constellation tokens are a group of tokens that are inter-tradeable with each other but with the profits being invested into the liquidity pairs of each pool and also burning tokens which are always reducing the supply.

The important part, the contract owners' liquidity in each pool is locked, on the chain, impossible to withdraw and constantly growing.

The X7100 series can be considered a “liquidity sink” for the X7D token.

The X7D is a 1:1 ratio token with ETH which is a 'receipt' for depositing ETH to the X7 lending pool.

The locked liquidity in the X7100 constellation serves as a reserve against which X7D can be withdrawn back into ETH, ensuring that X7D depositors can withdraw ETH at any time without waiting for a loan to come due.

The locked liquidity in the X7100 constellation also gives a signal of lending pool profit and helps to ensure an ever-growing capacity to mint X7D. By having a significant portion of the loan proceeds turned into locked liquidity in the X7100 series, the growth of the lending pool capacity supports the value of the X7100 series tokens, which in turn supports the lending pool capacity.