Source: https://www.ledger.com/

Ushering in a new post-FTX era for DeFi

Centralization of services within the crypto space did give the mirage of simplicity and convenience. With many participants attracted by the volatility, potential and illusion of quick riches, these services were not only tolerated, they thrived. Until they didn't.

Greed, coupled with a lack of transparency has led to catastrophic results with billions of dollars of investor funds lost. Yet the position we are in now was never the intention of decentralized finance. So whilst it is far from an ideal situation, it is an ideal time to reflect on the future of the crypto industry and the role that DeFi can play in evolving to solve real problems and meet real needs.

Source: https://blog.cleo.one/

What problems does DeFi seek to solve?

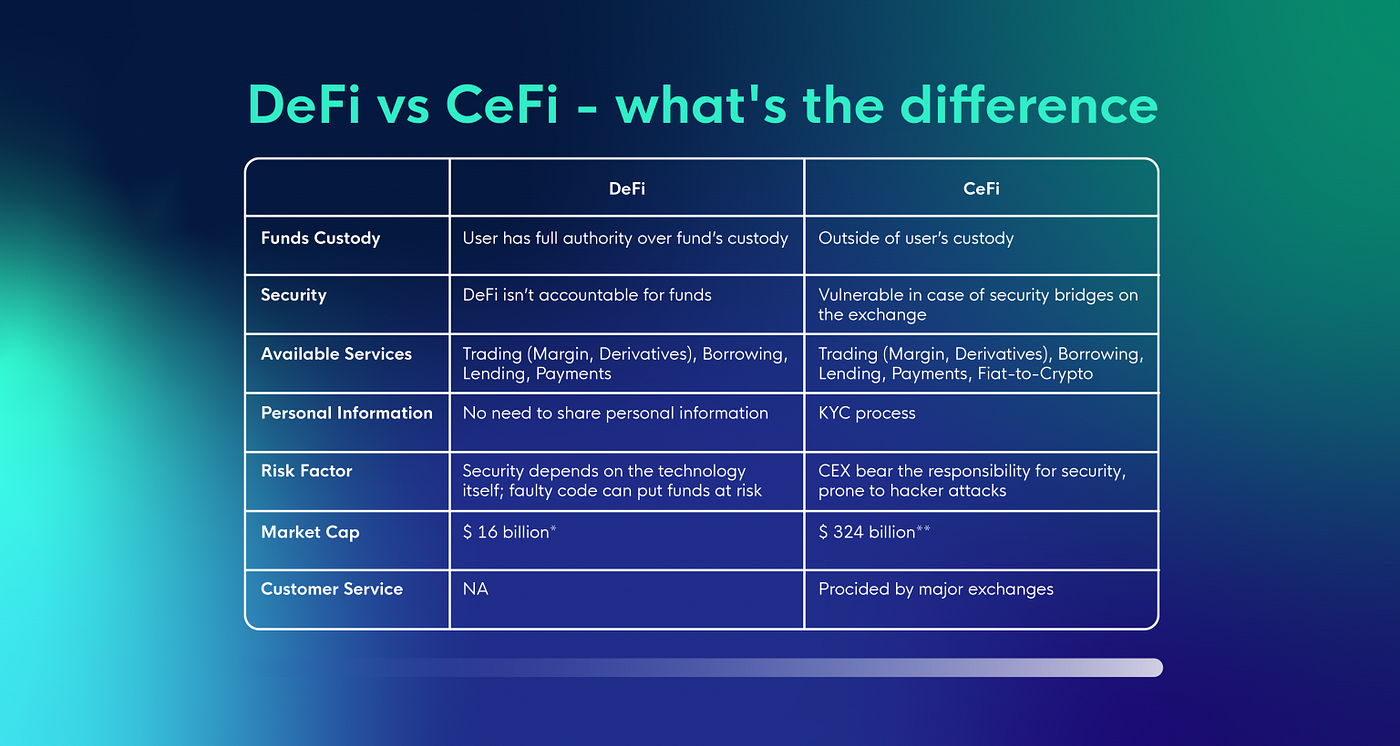

DeFi has the potential to solve key challenges around; centralized control, limitations in access, inefficiency, interoperability, and the opacity that are often hallmarks of the incumbent centralized financial system.

Centralized control was clearly demonstrated by the collapse of FTX. A centralized entity controlled user funds, and used, and lost user funds. In many cases they also limited who could access certain services and instruments, based on for example geographical location. Both inefficiencies, interoperability and opacity were rolled up into one and clearly demonstrated in the case of FTX with a lack of proper accounting, flow of funds and transparency of reserves.

This is just one example that is reflected across all manner of centralized financial infrastructure. The intention of DeFi was to replace this inefficient infrastructure with decentralized smart contracts. Clearly we are not there yet. DeFi itself is still riddled with problems from smart contract risks to bad actors. It is an ideal time to focus the mind and push DeFi forward.

What does an ideal DeFi future look like?

Let's start with a hard coded non-inflationary asset, like Bitcoin or Ethereum (since it moved to Proof of Stake). We now have a currency that cannot be inflated by centralized agents. We hold the private keys to that currency. We are our own bank. Everything is fully collateralized, transparent and under our own control… and not at the mercy of centralized actors risking our funds with under-collateralized leverage and loans.

Beyond our own account (our crypto wallet) we will have DeFi infrastructure with a wide range of services that enable us to quickly, easily and efficiently transact in any way we want across any protocol and any asset — whether that's something as simple as making a payment, securing a loan, or managing an investment portfolio.

If we go one step further we have the potential to foster a new decentralized, open source, collaborative and secure form of entrepreneurialism open to all. This is something that first ICOs, then Uniswap liquidity pools have opened the door to. These have been plagued by regulatory ambiguity and endless scams. DeFi is a young, emerging technology that is moving at a rapid pace and the future is bright.

Next steps on the road to DeFi adoption

If one thing is certain the recent losses of billions in user funds will usher in a new era or rapid regulation for DeFi and the crypto industry as a whole. Projects will need to comply, or else be set up in totally decentralized manner that can exist alongside (or potentially outside) of regulations.

But some form of compliance is not all that is required for longer term credibility and adoption. We must move beyond the current status quo and bring a new level of legitimacy to DeFi. Projects with a real use case, business case and revenue streams.

This is where projects like X7 Finance are set to thrive over the coming months and years. X7 Finance is a fully decentralized peer-to-peer decentralized lending protocol and exchange that enables DeFi entrepreneurs with big ideas to gain access to launch seed capital, whilst enabling traders and investors access to a fast, efficient, secure and low cost trading experience across multiple assets.

The purpose of these articles is to provide a more rounded view of the big issues facing DeFi, to educate and inform on the broader principles driving a decentralized future. We will however be providing multiple Twitter threads and Medium articles diving deeper into the specifics of X7 Finance and how it is set up to address many of these issues and usher in a new era and a bright future for DeFi.