Project Summary

The X7 FINANCE Protocol intends to build the first truly decentralized finance protocol inclusive of the flagship Decentralized Exchange “DEX”. Censorship resistant and built across the IPFS protocol in the same vein as Cloudflare, Brave, or Microsoft ION. Preventing the control and overreach of authorities and ultimately protecting the privacy of its users and investors. But the DEX is only the beginning; allowing access to an all encompassing suite of financial tools, including collateral free lending, active and passive leverage trading, multi-tiered NFT access, staking and more. Imagine a decentralized JP Morgan Chase.

As a introduction, a few items to note. The protocol is in the V2 stage post launch. And in an effort to maintain privacy and decentralization. Our Devs are fully anonymous and are launching each stage of the protocol individually as to ensure the goal of the first truly decentralized finance protocol can be met and exceeded. Following on chain transactions we can see that the protocol is incredibly well capitalized, with a massive and growing marketing wallet tied to years of development across the Ethereum Blockchain. In fact all communication to this point has been shared via on chain messages or the X7.Finance website; including timelines, protocol details, launch plans, testing+auditing, and Tokenomics.

The below information has been shared and published via our Telegram research channel by community members and authenticated/verified via Blockchain research. Because of the audacious nature of the project it requires a high level of complexity and multiple tokens in the ecosystem, some of which utility hasn't been fully revealed yet.

V1 aka Pre-Launch (An Exercise In Trust)

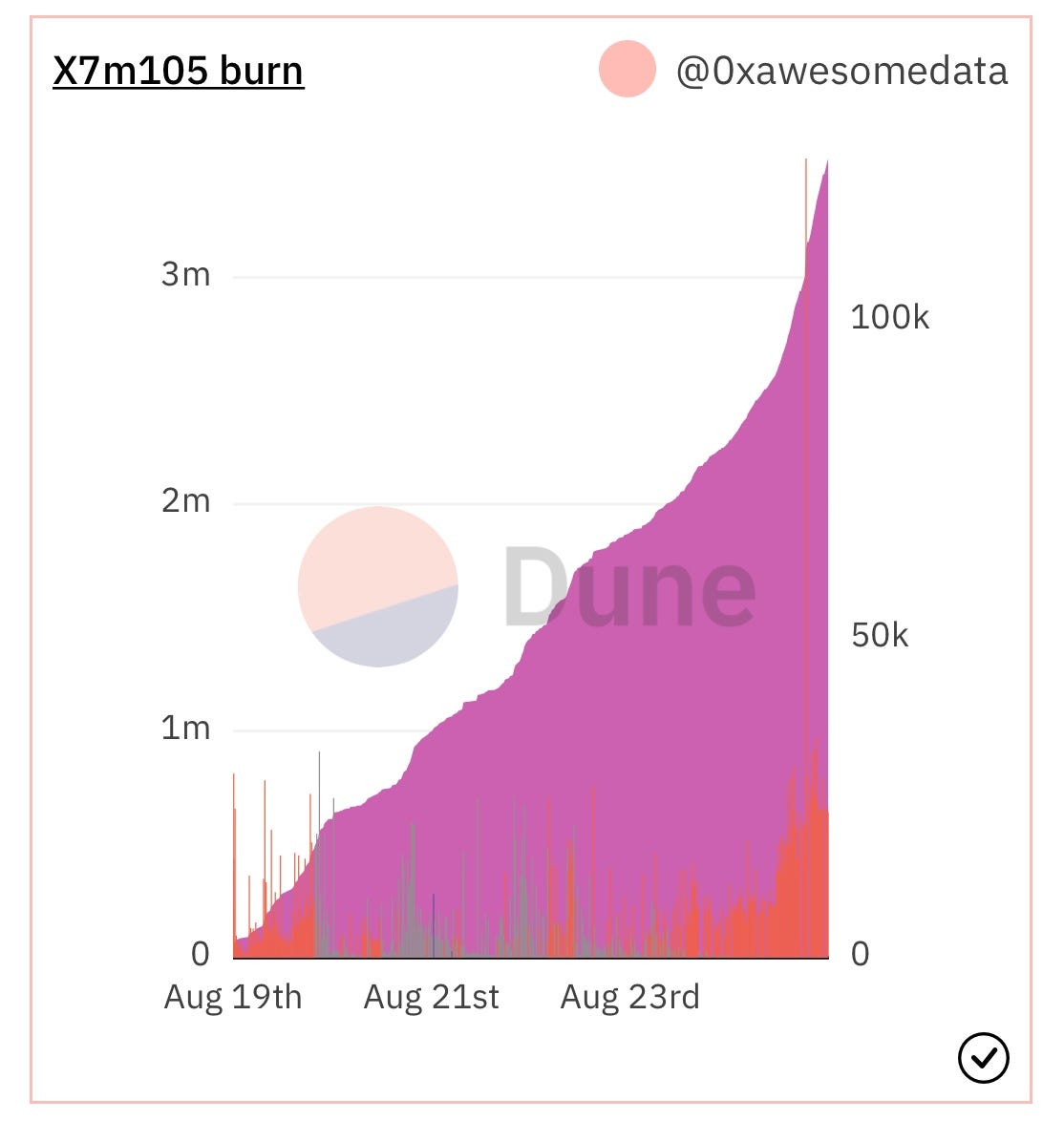

$X7m105 (the origin token for the X7 Protocol) was stealth launched on August 13th with no social media or website. Fully renounced, and without seed pricing or VC involvement. A community Telegram was created to speculate on the token. On August 19th, the second token of the X7 Ecosystem $X7DAO was launched, again with no announcement, and on August 23rd, the third token $X7 was launched in a similar manner. On August 19th, the first message from the dev team was received via a transfer from the $X7DAO deployer. “the event horizon of a black hole separates what happens outside from what happens within — the x7 protocol … you'll see” Days later, on the 23rd, the bomb was dropped. In yet another message from the $X7DAO deployer, the scope & purpose of the project was revealed. A shocking discovery in a sea of meme coins, cash grabs, and doomed ideas. A custom coded, intricately designed Uniswap fork DEX, consisting of 7 tokens and a central protocol token. The DEX will be hosted on IPFS for added censorship resistance and all communications will be handled on-chain. It is truly the essence of decentralization. The project consists of 8 tradable pairs. Each serving a very unique purpose. $X7m105- the deflationary reward token. $X7DAO- governance. $X7 Token was to be merged into $X7m105 to increase liquidity and burn rate. $X7001- $X7005- an arbitrage experiment in shared, linked liquidity. All the liquidity from the ecosystem flowed back to X7m105/X7 now post V2 merged to form $X7R the hyper deflationary core rewards token The combo of these factors making it an enticing investment and a great long term hold.

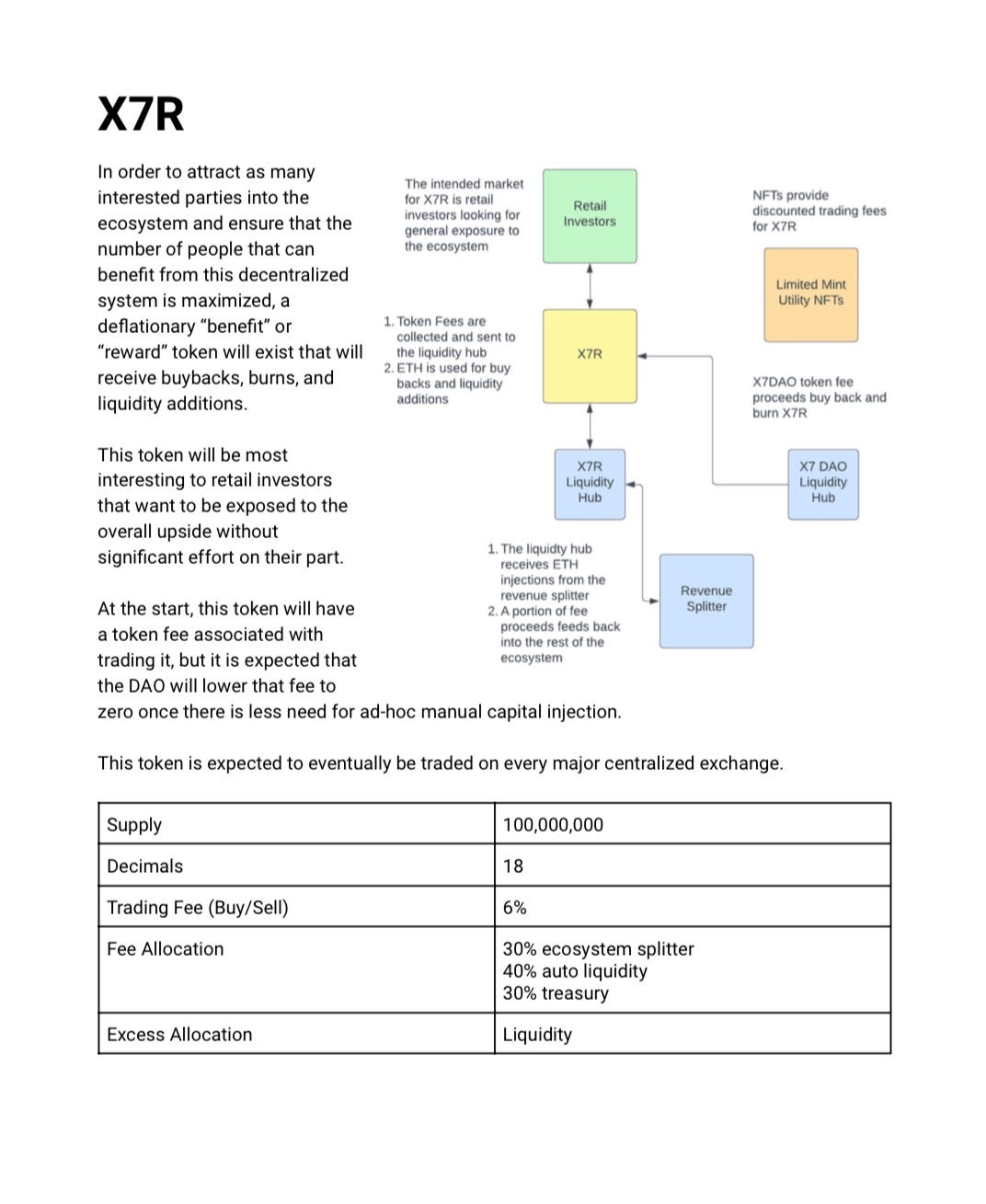

See Below for full X7R Tokenomics Flow👇🏻

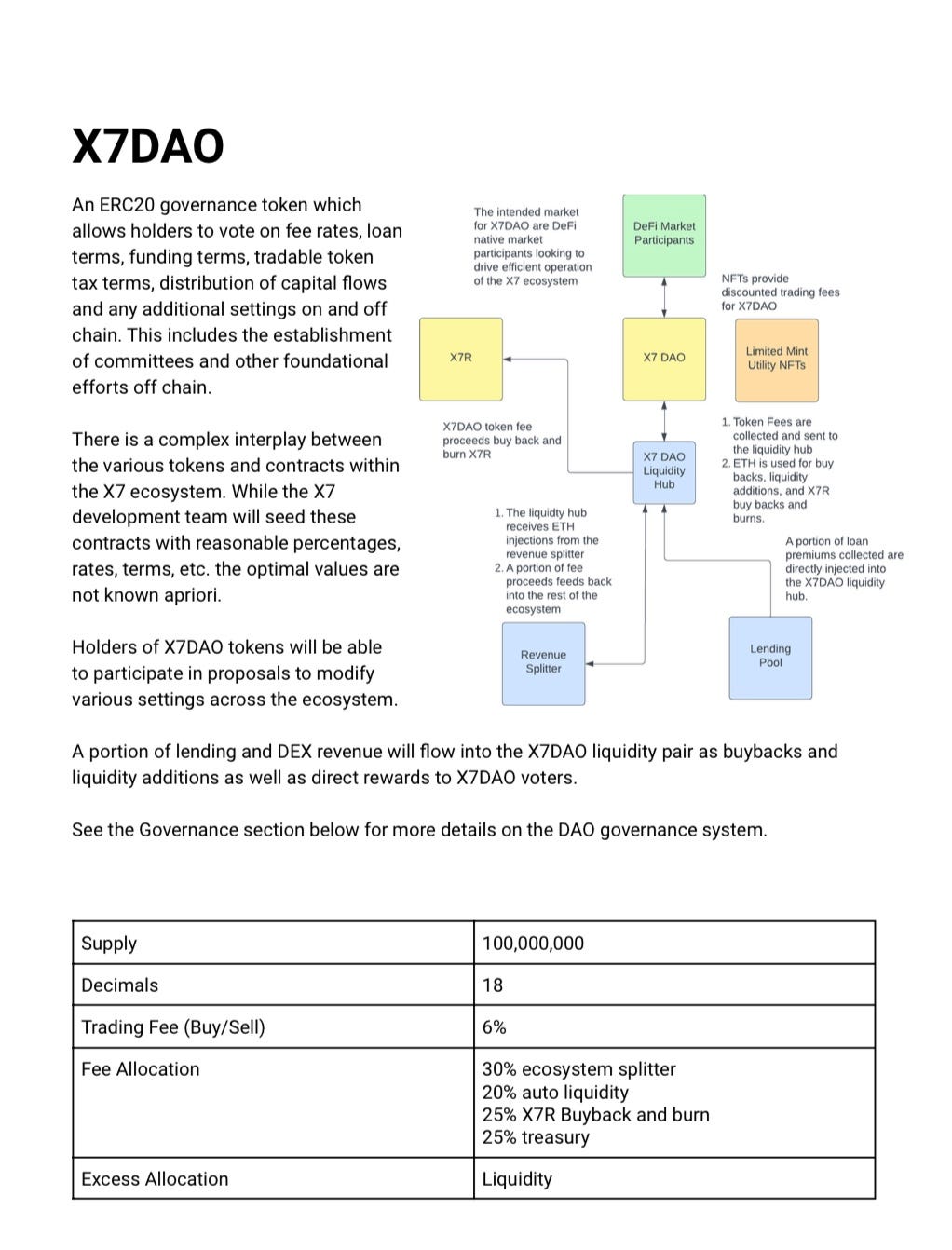

$X7DAO = the governance token. For now, it grants discounted trading of the $X7000 series tokens, in the very near future it will grant voting rights to dictate loan terms for the ILO platform, marketing deployment, and protocol tax plus much more.

WP notes on the DAO handoff from the Devs

“As the DAO handoff occurs, and DAO participants self-organize to maximize their profitability, we expect an increasingly rapid turnover of control until the only special control the X7 development team has is through the Magister NFTs. And so to, that level of control will diminish over time.”

“The X7 DAO structure is highly codified and provides almost no direct latitude for human intervention. This is by design and is one of the greatest strengths of the X7 DAO governance structure.

There is however a chance that through collusion and the inaction of DAO holders a large DAO holder could submit a proposal that was in their best interest and and not the best interest of the project.

To help provide a check and balance, a maximum of 49 Magister tokens can be minted. Seven of these tokens were minted and given to the X7 development team. The other 42 may be minted for a fee.

Any proposal may be vetoed by a majority of minted Magister tokens. It will require a 3⁄4 supermajority DAO vote to overturn a Magister veto.

An additional side effect of this governance feature is that the original ecosystem developers will retain a level of authority at the beginning of DAO control handover, but this authority can and will be diluted as Magister tokens are minted. The final governance influence of the original developers will become minimal once all Magister tokens have been minted, and once 8 additional Magister tokens are minted the original developers will no longer maintain a controlling voting block on Magister votes.”

The 5 $X7000 series tokens are all paired with ETH, as well as each other. When the DEX goes live, a portion of the fees will go to these pairs as liquidity. Long term holders can expect an ever deepening liquidity pool and price floor as funds from the DEX flow in. Short and mid term holders of X7001-X7005 can enjoy arbitrage opportunities across the pairs. In order to make arbitrage more practical the X7001-X7005 can be traded at a discounted fee by holding >= 50,000 #X7DAO tokens. Arbitrage will ensure that X7001-X7005 tokens will maintain a similar price (and due to liquidity tax and the DEX profits, these tokens will have a constantly rising floor). At the heart of X7 Finance Protocol lies the liquidity and this is where things get interesting. This ecosystem includes a pseudo-undercollateralized loan protocol in the context of Initial Liquidity Offerings. In that context it is possible for a borrower to borrow ETH and pay loan premiums, much like a traditional loan, and the liquidity pair itself can act as collateral. The liquidity hub will orchestrate these liquidity injection loans. Loan proceeds will flow across the $X7000 series, $X7DAO governance token, and $X7R in the form of liquidity injections and buy backs.

X7 ecosystem token Liquidity Provider Tokens (LP)

Dev Note: The original stealth launched tokens had their liquidity tokens sent to the burn wallet. This was to instill confidence in investors of a stealth launch that there was no intention or ability to withdraw the capital in the liquidity pairs.

While the X7 ecosystem of smart contracts are built with the flexibility and resilience to last, it is possible that eventually a systemic upgrade will need to take place. All X7 ecosystem tokens LP tokens (initial + auto liquidity) are being locked in a time-lock contract. The default destination for this LP will be the burn wallet and the starting lock time will be 2 years. The DAO will be able to perform any of the following actions on the time lock contract.

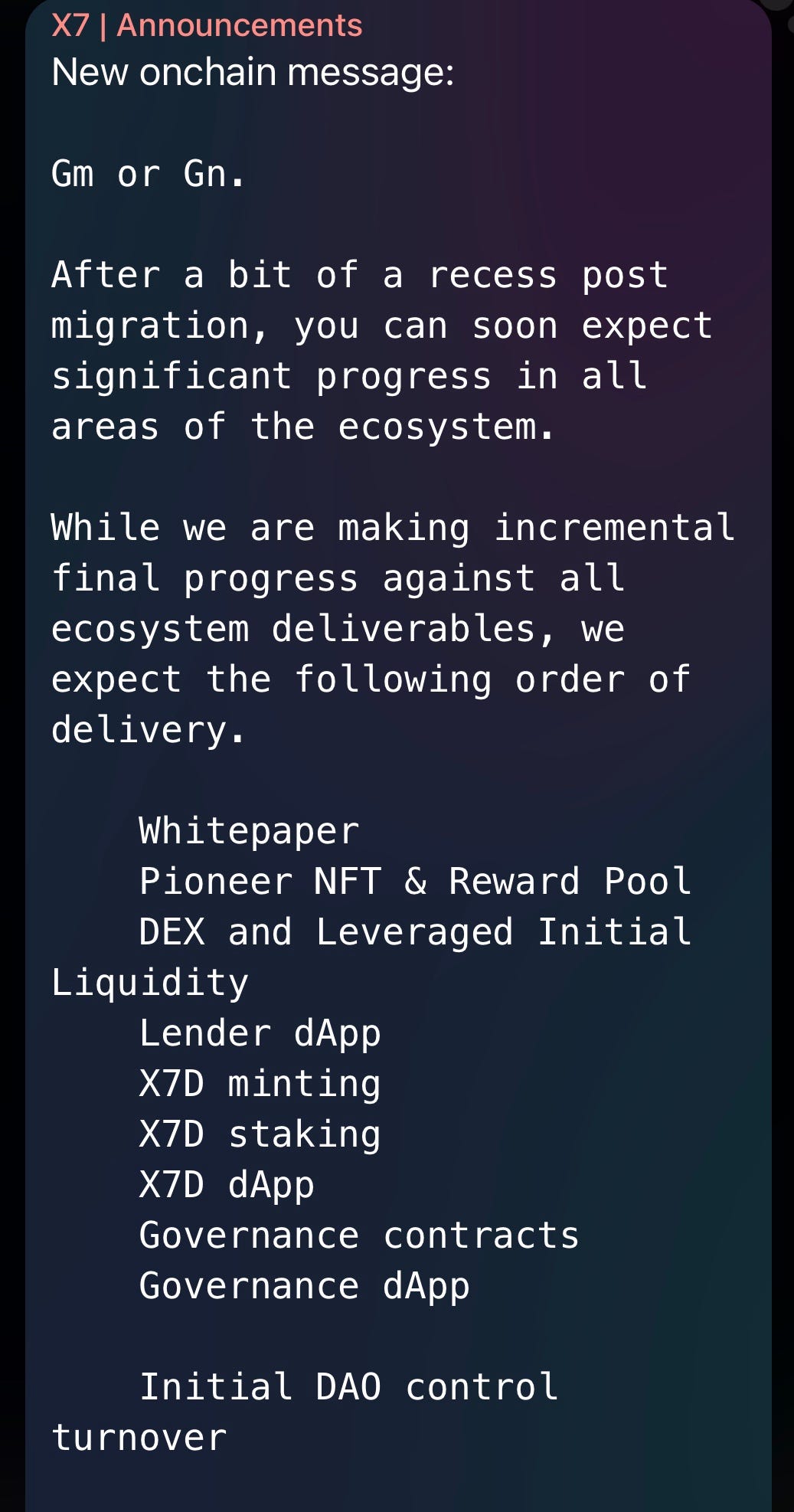

The Dev team for this project has performed flawlessly in the roll out of this unique ecosystem, with no delays and ample communication via weekly sometimes daily on-chain messages. The next steps in the project are the creation of the DEX contract, and deployment of the user facing UI. More to come as more information is shared on chain regarding what is short to be a game changing protocol in our space. Please review the attached media below for a series of Dev launched supporting documents and visual aids.

Tokenomics Notes

A typical structure for funding project operations from tokens is to collect a percentage of traded tokens and periodically swap those tokens in the ETH pair.

- The variables associated with this activity are:

- Percent of swap transaction tokens collected on buys and sells

- The token balance threshold at which to swap tokens into ETH

- The maximum swap transaction size (to limit extreme downward price action and maximize token return).

- Allocation of swapped ETH:

a. Collected for operations

b. Buy back and burn

c. Buy back and add liquidity

- All of these settings will be dynamic and modifiable to affect the allocations of capital throughout the ecosystem.

- Advanced Trading and Revenues

- There will be a complex interplay between the transfer of funds between:

● The lending pool

● The staked (pegged) ETH token

● The “constellation” token liquidity sink

● The reward token

● The dao token

At various moments money will flow between the lending pool, the constellation tokens, and the staked ETH token, and opportunistic traders may find swing trading or arbitrage trading profitable. This swing trading will drive tokens and fees back into the rest of the ecosystem and provide a solid financial vehicle for speculation on future growth.

The Weeks ahead:

X7's Decentralized Exchange will go live as a peer-to-peer Automated Market Making (AMM) integrated with a novel trustless, permissionless on-chain undercollateralized loan origination and servicing system known as the Lending Pool. This section will describe the core functionality of the operations of DEX.

Technical Abstract

Xchange is built on a forked version of the Uniswap V2 Factory, Liquidity Pair, and Router contracts. There are two notable changes:

● The Liquidity Pair contract has added safeguards to allow it to support leveraged liquidity additions that ensure the leverage remains collateralized and can be liquidated in the event of loan default and appropriately manage Liquidity Tokens during an active Initial Liquidity Loan.

● The liquidity provider fee has been reduced from 0.3% to 0.2%. This reflects the reality that in many cases the liquidity providers for tokens are actually the token creators and the benefit they receive is more often via token price appreciation or token fees, not liquidity providing.

Additionally, the User Interface will allow a seamless experience trading across other Uniswap V2 style decentralized exchange pairs (such as uniswap or sushiswap).

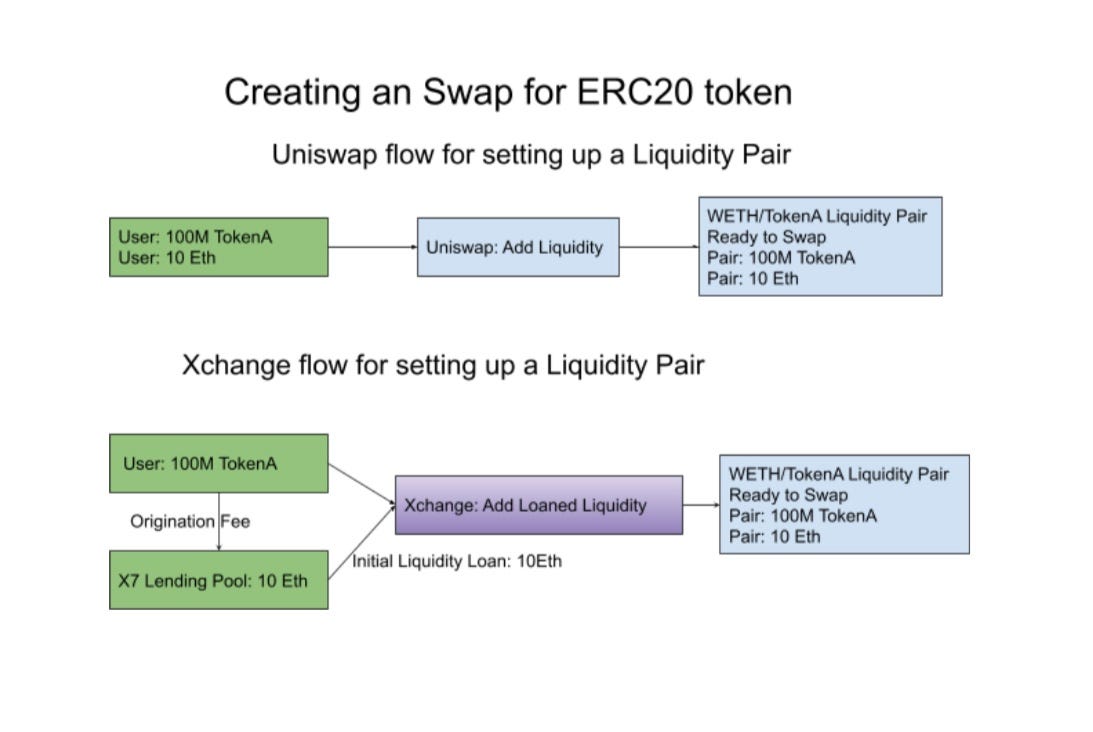

Understanding Swap Creation

A quick overview of how a user creates the ability to Swap tokens. The contract that actually allows swapping is called a Liquidity Pair.

In Uniswap, a user has 100M TokenA and & 10 ETH and wants to launch a Swap: calls TokenA#approve, then calls the Uniswap#AddLiquidityETH function sending 100M TokenA and 10Eth. A successful result yields a newly launched Liquidity Pair contract with 100M TokenA and 10Eth of liquidity.

In Xchange, a user has 100M TokenA and & 1 ETH and wants to launch a Swap with 10 ETH of Liquidity: calls TokenA#approve, then calls the Xchange#AddLoanedLiqudiity function sending 100M TokenA and 1Eth and a selected Initial Liquidity Loan. A successful result yields a newly launched contract with 100M TokenA and 10Eth of liquidity.

Trading Functionality and Swap

Similar to Uniswap, token swaps in Xchange are a simple way to trade one ERC-20 token for another.

For end-users, swapping is intuitive: a user picks an input token and an output token. They specify an input amount, and the protocol calculates how much of the output token they'll receive. They then execute the swap with one click, receiving the output token in their wallet immediately.

Swaps in Xchange are different from trades on traditional centralized exchange platforms. Xchange does not use an order book to represent liquidity or determine prices. Xchange uses a constant product automated market maker mechanism to provide instant feedback on rates and slippage.

Lending Pool

Lending Pool Overview

To provide leverage to the system, the Lending Pool acts as the manager of both funds and loans. This contract will be interacted with by Xchange.

Lending Pool Funding

To fund the Lending Pool, ETH from the X7 token ecosystem has been accumulating in the Ecosystem Splitter and will be the first liquidity deposited into the Lending Pool. This ETH will be locked forever and will grow over time. Users are also able to contribute to the Lending Pool via Deposits.

Deposits

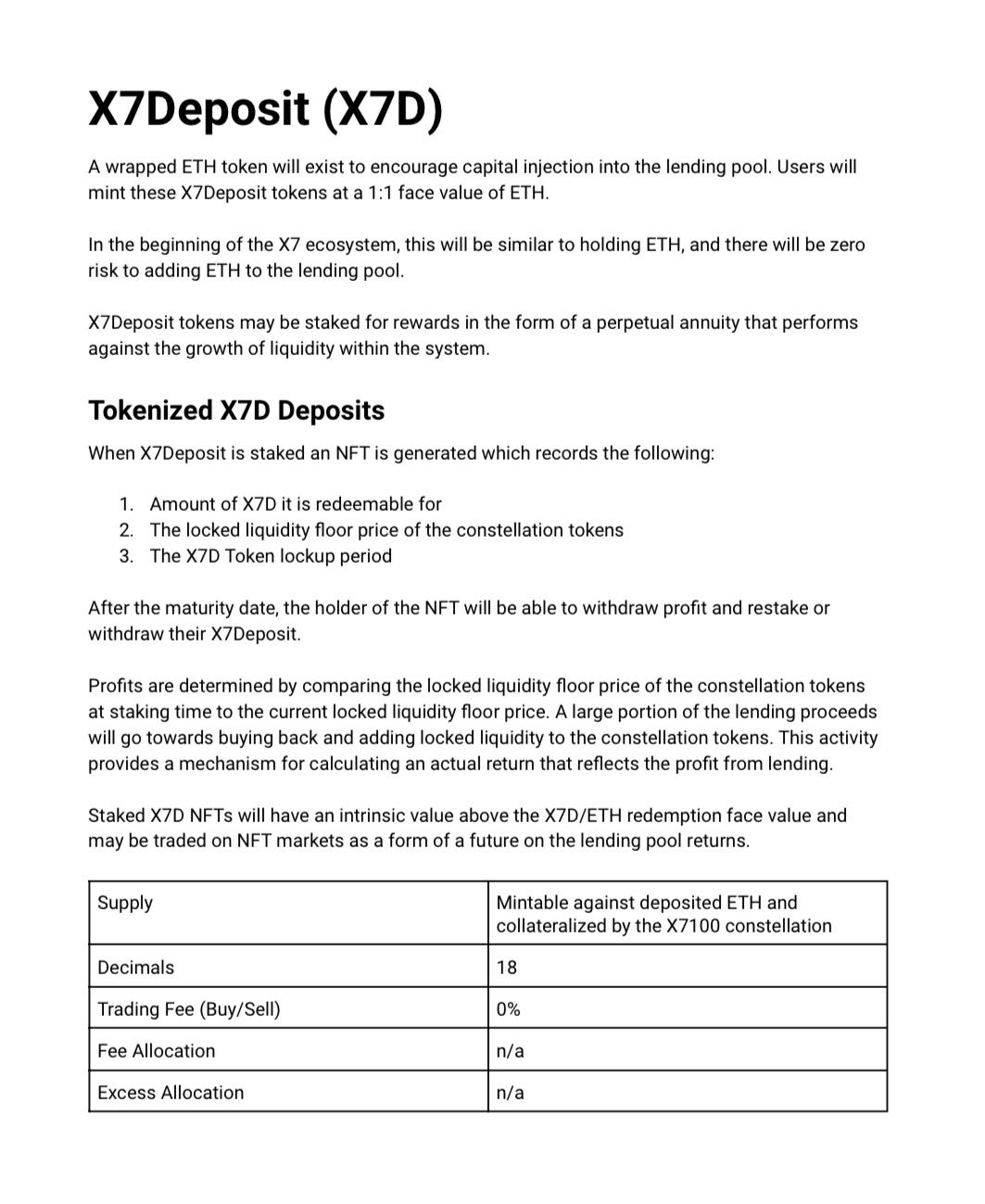

Users will be able to deposit ETH and receive an X7 deposit token. When X7Deposit is minted, it is a face value equivalent to ETH.

1 X7D = 1 ETH

When deposited, the ETH will enter the lending pool and be available for automated lending.

The lending pool will maintain a reserve of constellation tokens sufficient to back any externally funded lending pool liquidity.

X7D tokens can be wrapped in an NFT and staked. At maturity, this NFT will pay returns based on the rising constellation token floor.

Lending Functionality

Lending is a fully automatic process managed fully by Xchange's interfacing with the Lending Pool via Initial Liquidity Loans.

For end-users, wanting to participate in lending: a user selects the amount of Ether to deposit or withdraw from the Lending Pool. Receipts for deposit are issued in X7 deposit, redeemable 1-to-1 with Eth, and may be staked for a portion of the loan fees.

Initial Liquidity Loan

An initial liquidity loan provides a mechanism to add initial liquidity to an automated market making trading pair with borrowed capital. The terms and conditions for borrowing this capital and returning it to the lender provide for the lender and the borrower to manage their cost of capital and repayment schedules in a way that supports the nature of the offering and the size and duration of the loan.

Initial Liquidity Loan Terms

Loan terms are defined by standalone smart contracts that provide the following:

- Loan origination fee

- Loan retention premium fee schedule

- Principal repayment condition/maximum loan duration

- Liquidation conditions and Reward

- Loan duration

Spend some time reading through the white paper to understand simple loans, amortization, lending pool origination, and our loan poll governance. It is clear that our developers have master class support from both traditional banking thought and decentralized finance.

V2 Post Launch Updates

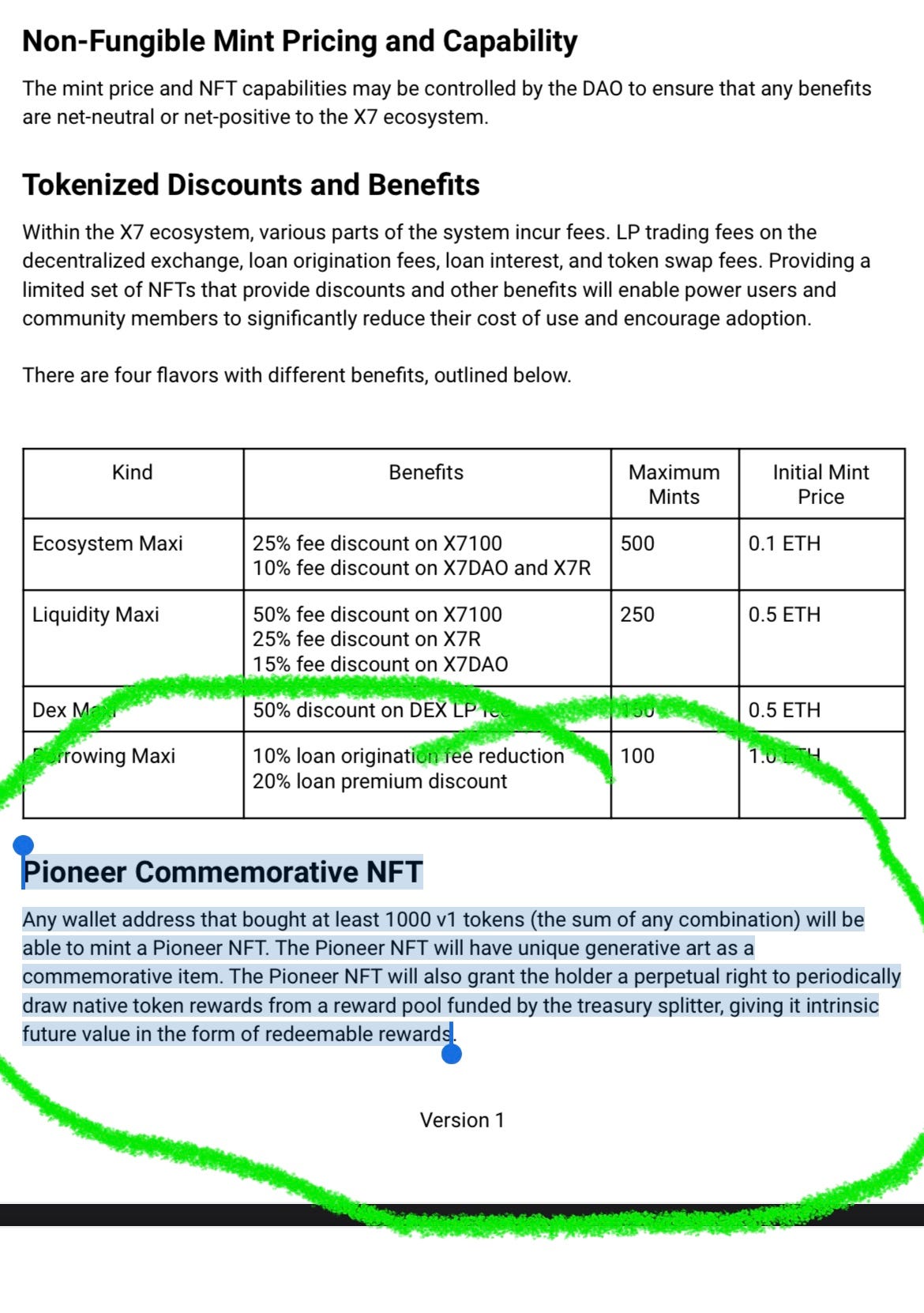

X7 Utility NFTs are built maximize your trading. 4 Maxi NFTs and 1 Magister NFT contract.

They provide a litany of benefits including trading discounts, reward benefits, and increased governance sway.

X7D Info to Date

At a time with so many false promises, and failed launches it has been refreshing to see such an efficient, strategic, and thought-provoking launch centered around creating a censorship resistant DEX and DeFi protocol. Due to the uncertainty in the macro-global economic environment and the increase in censorship, and overreach. Never has a project had more right and/or market fit than the X7 protocol does today. Which is no doubt why it has garnered such rapid attention from thought-leaders throughout the space, the Cult DAO, and the formation of the XForce community worldwide. #XForceUnite

Update 2.0: Additional information will be shared as new messages are received and marketing begins deployment.

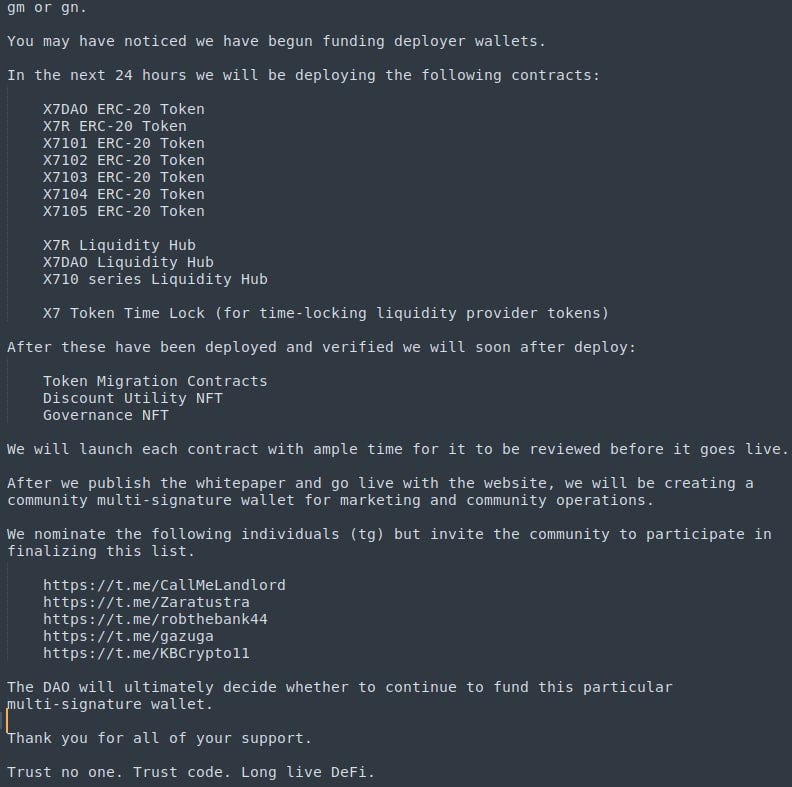

Sept. 12 Chain update*

Inclusive of nominations for the DAO multisig wallet. And most importantly the X7R contract will deploy within the next 24 hours.

Sept. 13th On-Chain Update **

(Minor) There at least one more contract deployment to fill out the pre-migration lineup.

(Major) The V2/X7R migration will occur in

3 phases. Please review carefully!

Phase 1: Stage the V1 tokens in a migration contract

Phase 2: Snapshot and verify

Phase 3: Migrate Liquidity and Airdrop v2 Tokens

Phase 1 will last for between 36–48 hours or until a sufficient number of tokens have been collected.

A dapp haS BEEN be provided for your convenience.

Phase 2 will last for approximately 24 hours to ensure everyone can review the snapshot that has been written to the migration contract so we can correct any discrepancies.

Phase 3 will occur shortly after phase 2 closes, and will include migrating liquidity from v1 pairs into v2 pairs! V2 token will be airdropped to those who completed Phase 1.

This will conclude the automated portion of the V1 to V2 upgrade. Any V1 tokens that have not migrated at this point will require manual migration. Steps will be provided after Phase 3 completes. The newly migrated tokens will immediately be available for trading.

X7R contract is has been deployed and fully verified and awaiting phase 3 completion.

See Here. ⬇️

0x70008F18Fc58928dcE982b0A69C2c21ff80Dca54

Which we have confirmed to be the new merged version off X7 and 105 previously discussed, it is deflationary driven by burns and buybacks. And will be an incredible long term hold. Fed by the full ecosystem.

Similar mechanics to 105. See below ⬇️

Any address that fails to stage their tokens will need to deposit and manually withdraw their new tokens from the migration contract!

Sept 19th Update: Migration/V2 is imminent. Please standby for instruction on Merge/Mint and Migration. Migration Has been completed successfully.

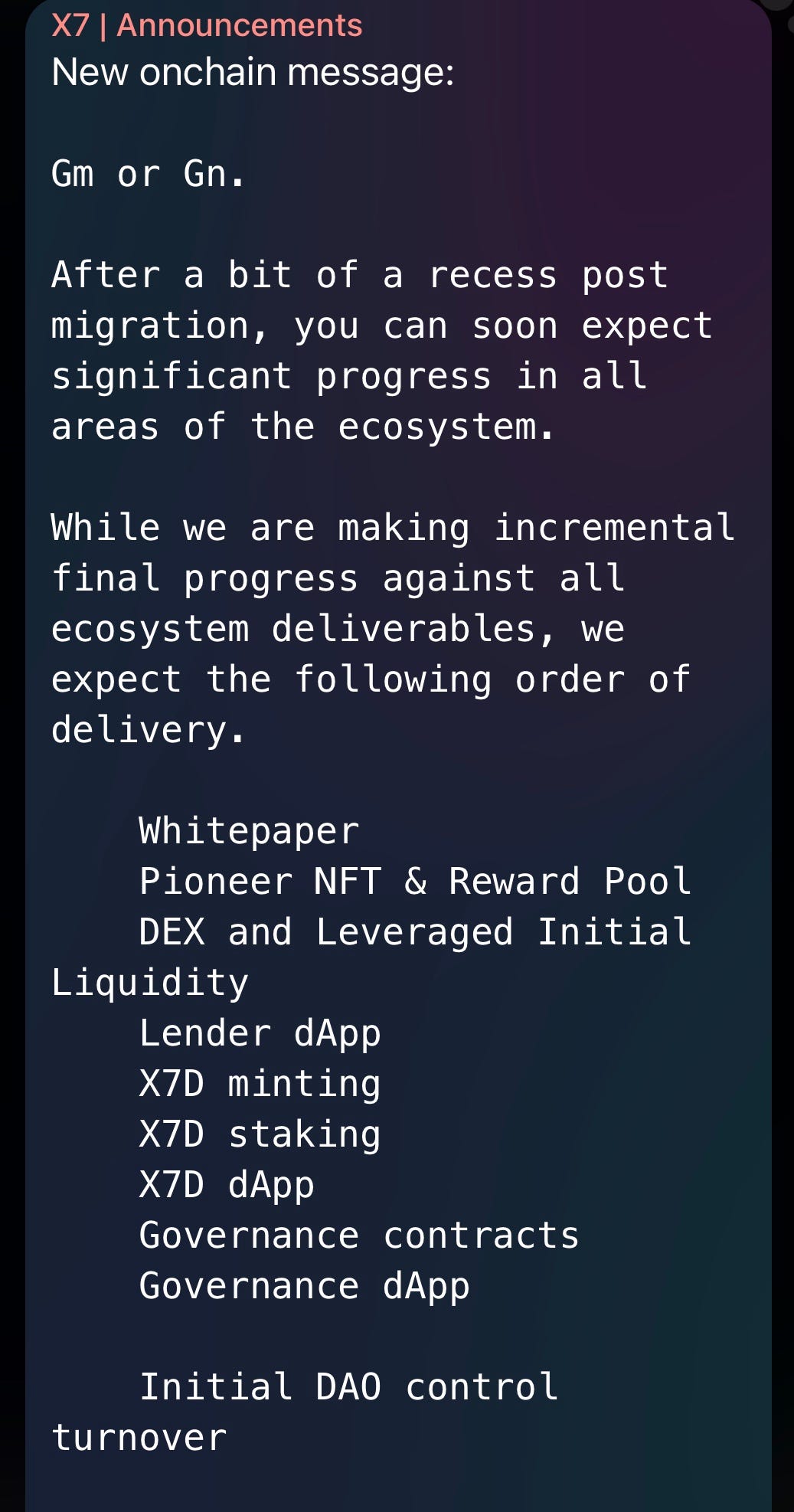

October On Chain Updates: Inclusive of linear timeline updates.

The sun rises on the X7 v2 ecosystem, ready to meet the demands of a world class DEX, lending protocol, and DAO.

#XForceUnite

Stay tuned for further updates. Thanks for reading!

Trust no one. Trust code. Long live DeFi.